Citi's AI Revolution: How Private LLMs and Data Sovereignty Are Reshaping Enterprise Banking

September 2025 | HumaticAI Insights

The Strategic Shift: Citi's Enterprise AI Transformation

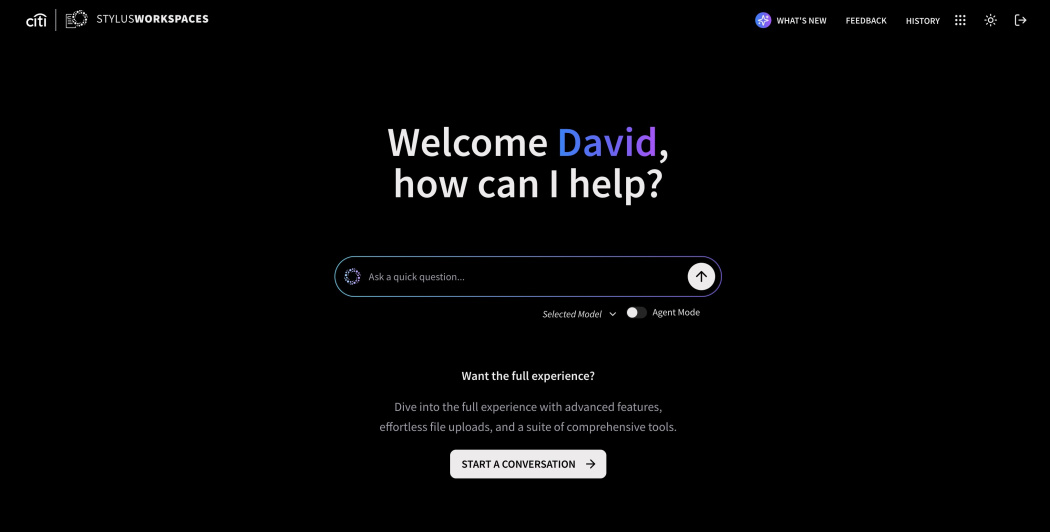

Citigroup is undergoing one of the most ambitious AI transformations in the financial services industry, positioning itself at the forefront of enterprise AI adoption. The banking giant's recent rollout of Citi Stylus Workspaces with agentic AI capabilities represents a fundamental shift in how financial institutions approach artificial intelligence.

What Citi Is Planning: The Agentic AI Pilot

Citi's strategy centers around their proprietary AI platform, Citi Stylus Workspaces, which has evolved from basic generative AI tools to sophisticated agentic capabilities. The current pilot involves 5,000 employees initially gaining access to these advanced AI capabilities across 80+ global markets, with recent expansions to Israel, Mexico, Philippines, and Switzerland.

As David Griffiths, CTO of Citi, explained in recent announcements, "The initial pilot will involve 5,000 users over a period of four to six weeks. The goal is to measure usage patterns, impact on productivity, and ensure the technology delivers meaningful value to our workforce." This measured approach reflects Citi's commitment to responsible AI deployment.

The platform takes a multi-model approach using Google's Gemini and Anthropic's Claude models, deeply integrated with Citi's internal systems, data repositories, and project management tools. These agentic capabilities enable employees to delegate complex workflows to AI agents that can autonomously research clients, build presentations, analyze market data, and complete multi-step tasks that previously required significant manual effort.

Expected Business Impact: Productivity Revolution

Citi's AI implementation is projected to deliver substantial business value through unprecedented productivity gains. The bank anticipates automating approximately 80% of routine banking tasks including data entry, report generation, and compliance checks. Their developer AI tool, Citi Squad, has already completed 740,000 automated reviews in 2024 alone, demonstrating the scale of efficiency improvements possible.

The operational efficiency extends to client communications through tools like "AskWealth" and "Advisor Insights," while CitiService Agent Assist enhances customer service by reducing response times. In specific applications like FX hedging, Citi has demonstrated 30% cost savings through AI-powered forecasting tools, showcasing the tangible financial benefits of their AI investments.

Technology Stack and Implementation Costs

Citi's technology infrastructure centers on their proprietary Citi Stylus Workspaces platform with agentic AI capabilities, integrating Google Gemini and Anthropic Claude models through consolidated data systems with enhanced security protocols. The implementation follows a private LLM processing model with on-premise and private cloud deployments.

The current investment includes an estimated $50-100 million for initial platform development, with ongoing operational costs of $10-20 million annually for model licensing and infrastructure. Employee training represents an additional $5-10 million investment for their 140,000+ global workforce. However, these investments are projected to yield $200-500 million annually in operational efficiency gains, with a 30-50% reduction in manual processing costs and an expected ROI timeline of 12-18 months for major implementations.

The Critical Role of Private LLM Processing and Data Sovereignty

Citi's approach highlights why private LLM processing and data sovereignty are non-negotiable for enterprise AI workloads in regulated industries. Financial institutions operate under strict regulations including GDPR, CCPA, and various banking secrecy laws, making private LLMs essential for ensuring client data never leaves controlled environments.

The intellectual property protection aspect cannot be overstated—proprietary trading strategies and financial models remain confidential through on-premise processing, preserving competitive advantage while eliminating the risk of training data leakage to external AI providers. Performance and reliability benefits include dedicated infrastructure ensuring consistent performance for time-sensitive financial operations, reduced latency for real-time trading and risk management applications, and custom model fine-tuning for financial domain specificity.

From a cost perspective, private processing avoids unpredictable API costs from public AI providers while enabling fixed infrastructure costs for accurate budgeting. This approach eliminates vendor lock-in and dependency on external AI providers, giving Citi complete control over their AI destiny.

The Future Outlook: Agentic AI in Financial Services

Citi's pilot represents the beginning of a broader industry transformation with the 2025-2028 period identified as the critical window for agentic AI deployment. The bank plans to expand these capabilities across 40,000+ developers and financial professionals, eventually moving to client-facing applications and automated advisory services with integration into blockchain and digital asset platforms.

The long-term vision includes autonomous financial agents handling complex multi-step transactions, AI-driven portfolio management and risk assessment, and personalized banking experiences powered by predictive AI. This evolution represents not just technological advancement but a fundamental reimagining of financial services delivery.

Key Takeaways for Enterprise AI Strategy

Citi's approach demonstrates several critical success factors that other enterprises should consider. Starting with internal use cases before client-facing applications allows for controlled testing and refinement. Investing in proprietary platforms rather than relying solely on third-party solutions provides greater control and customization. Prioritizing data sovereignty from day one of AI implementation ensures regulatory compliance and security.

Measuring productivity gains rigorously helps justify continued investment while building scalable infrastructure ensures the AI implementation can grow with organizational adoption. These principles form a blueprint for successful enterprise AI transformation in regulated industries.

Conclusion: The New Era of Enterprise AI

Citi's AI transformation showcases how financial institutions can leverage private LLM processing to achieve both innovation and compliance. The combination of agentic AI capabilities with robust data sovereignty frameworks creates a sustainable approach to enterprise AI that balances technological advancement with regulatory requirements.

As Citi CEO Jane Fraser noted, "We are proactively embracing gen AI as an essential part of our strategy to win." This sentiment, combined with David Griffiths' measured approach to implementation, reflects the broader industry recognition that AI isn't just a technological upgrade—it's a fundamental reshaping of how financial services operate and compete in the digital age.

For organizations considering similar transformations, Citi's journey underscores that the future belongs to those who can balance AI innovation with enterprise-grade security and compliance, proving that in the world of enterprise AI, sovereignty isn't just an option—it's a strategic imperative.

Ready to transform your enterprise with private AI?

Learn how HumaticAI can help you implement secure, compliant AI solutions that deliver immediate value while maintaining data sovereignty.

HumaticAI provides strategic advisory and implementation services for enterprise AI transformations with a focus on private LLM deployment and data sovereignty. Contact us to learn how our expertise in secure AI infrastructure can accelerate your organization's digital transformation while maintaining regulatory compliance and competitive advantage.